What can Build-to-Rent still learn from the US multi-family market?

The multifamily rental market is well-established in the United States. Considering the differences between UK ‘Build to Rent’ & US ‘multifamily’ schemes, Director Michael Swiszczowski considers whether we have more to learn from the US, or could it be the other way around? Following a study visit to San Diego, he assesses some of the schemes there and what they have to offer in the way of location, interiors, space and amenity.

As the UK Build-to-Rent (BtR) market has emerged, grown and matured, it has periodically cross-referenced the very mature multifamily market in the US. In fact, we, amongst many others within the UK BtR community, have written several papers analysing what lessons can be learnt from the US. As BtR started to gain popularity in the UK, we have taken part in extensive discussions to define the key design principles that differentiate BtR/Multi-family schemes from the Private Rented Sector (or ‘mom and pop’ landlord businesses) in both markets.

Whilst we are still decades behind the US, in terms of when our rental market evolved to become a professionally managed, institutionally backed market; we are not necessarily ‘behind’ in a figurative sense. A recent visit to San Diego, as part of a study tour organised by the UKAA, presented an opportunity to spend some time reflecting on what differences remain between the two markets as well as note the, somewhat expected, abundance of similarities. Perhaps what was most striking is that not all differences which remain are a result of the US being ‘more mature’ and in fact, we believe there are things the US multi-family market could learn from the way the UK Build-to-Rent market has evolved.

The multifamily rental market is well-established in the United States. Considering the differences between UK ‘Build to Rent’ & US ‘multifamily’ schemes, Director Michael Swiszczowski considers whether we have more to learn from the US, or could it be the other way around? Following a study visit to San Diego, he assesses some of the schemes there and what they have to offer in the way of location, interiors, space and amenity.

As the UK Build-to-Rent (BtR) market has emerged, grown and matured, it has periodically cross-referenced the very mature multifamily market in the US. In fact, we, amongst many others within the UK BtR community, have written several papers analysing what lessons can be learnt from the US. As BtR started to gain popularity in the UK, we have taken part in extensive discussions to define the key design principles that differentiate BtR/Multi-family schemes from the Private Rented Sector (or ‘mom and pop’ landlord businesses) in both markets.

Whilst we are still decades behind the US, in terms of when our rental market evolved to become a professionally managed, institutionally backed market; we are not necessarily ‘behind’ in a figurative sense. A recent visit to San Diego, as part of a study tour organised by the UKAA, presented an opportunity to spend some time reflecting on what differences remain between the two markets as well as note the, somewhat expected, abundance of similarities. Perhaps what was most striking is that not all differences which remain are a result of the US being ‘more mature’ and in fact, we believe there are things the US multi-family market could learn from the way the UK Build-to-Rent market has evolved.

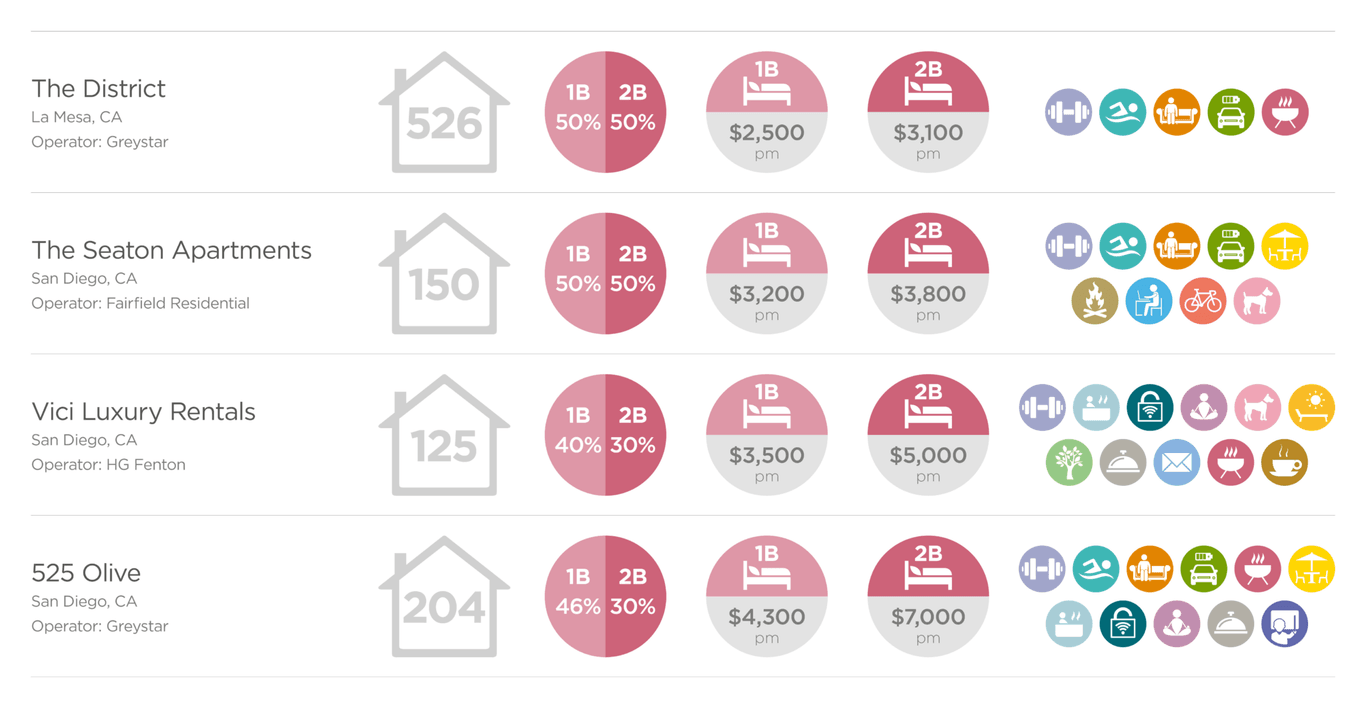

Examples of some California schemes:

The schemes that I saw were all pet friendly, some had pet spas and dog parks, and most had a gym or a health club. They all had like a clubhouse or a residents’ lounge or a social lounge and a pool/hot tub. Some advertised electric car charging. There were a few places with co-working facilities. Barbecues, fire pits and rooftop spaces were very common.

Typically, there are larger circulation spaces and bigger size apartments than in the UK. Signage is very prominent and often standardised, eg. men’s and women’s toilet signs, rules and regulations, there’s very little consideration of its impact on interior design.

The multifamily rental market is well-established in the United States. Considering the differences between UK ‘Build to Rent’ & US ‘multifamily’ schemes, Director Michael Swiszczowski considers whether we have more to learn from the US, or could it be the other way around? Following a study visit to San Diego, he assesses some of the schemes there and what they have to offer in the way of location, interiors, space and amenity.

As the UK Build-to-Rent (BtR) market has emerged, grown and matured, it has periodically cross-referenced the very mature multifamily market in the US. In fact, we, amongst many others within the UK BtR community, have written several papers analysing what lessons can be learnt from the US. As BtR started to gain popularity in the UK, we have taken part in extensive discussions to define the key design principles that differentiate BtR/Multi-family schemes from the Private Rented Sector (or ‘mom and pop’ landlord businesses) in both markets.

Whilst we are still decades behind the US, in terms of when our rental market evolved to become a professionally managed, institutionally backed market; we are not necessarily ‘behind’ in a figurative sense. A recent visit to San Diego, as part of a study tour organised by the UKAA, presented an opportunity to spend some time reflecting on what differences remain between the two markets as well as note the, somewhat expected, abundance of similarities. Perhaps what was most striking is that not all differences which remain are a result of the US being ‘more mature’ and in fact, we believe there are things the US multi-family market could learn from the way the UK Build-to-Rent market has evolved.

Before going into detail highlighting the nuances of the schemes we visited, it is perhaps of greater use to summarise the key differences between the UK and US markets.

Tenancy attitudes

When the BtR sector began emerging in the UK, many people felt there was a need for an alternative to the largely unregulated PRS sector with arguments for a new approach centred around tenants' rights. Along with a cultural shift towards no longer using the term ‘tenant’ itself (due to negative connotations of the imbalance of power between landlord and tenant) it was suggested that ‘residents’ should have greater security in their tenancy length to prevent people and families being uprooted from their ‘home’ with relatively little notice and no justification necessarily being required or given.

To facilitate this, a much more user-focused approach towards design was encouraged. Primarily, this meant designing a range of apartment sizes and tenures to suit the various stages of people’s lives. Assuming the goal of creating a community within a BtR development could be achieved, it was then about ensuring people had the opportunity to stay, with an appropriate apartment mix meaning they did not simply have to ‘move on’ when they wanted to enter into a long-term relationship, get married, start a family or any another equally significant lifestyle change. Some of the subtleties of the design approach towards the apartment types and interior design included creating apartments specifically designed for sharers, who would appreciate their own bathroom or ensuite rather than sharing, or perhaps having parity when it came to bedroom sizes (simplifying how a group may choose to ‘split the rent’). Similar to the UK, the US examples we saw tended to avoid smaller, single-bed type bedrooms and focus much on spaces suitable for a range of people. Likewise, the approach to storage was key and was largely comparable between the UK and the US, once you take into account the scalable uplift in space standards.

One of the more unique elements witnessed in the US was the adoption of external storage – accessed from the apartment’s balconies or private terrace, providing convenient storage options for outdoor seating or garden equipment, including BBQs (although all schemes we were shown had attractive communal BBQs). Alongside the more patent weather differences, perhaps another reason additional storage for furniture was so common was that there appeared a trend for most apartments to come unfurnished which is in direct contrast to the trend we have so far witnessed in the UK.

One of the more unique elements witnessed in the US was the adoption of external storage – accessed from the apartment’s balconies or private terrace, providing convenient storage options for outdoor seating or garden equipment, including BBQs (although all schemes we were shown had attractive communal BBQs). Alongside the more patent weather differences, perhaps another reason additional storage for furniture was so common was that there appeared a trend for most apartments to come unfurnished which is in direct contrast to the trend we have so far witnessed in the UK.

Differing attitudes towards home-ownership

Broadly speaking, there are cultural differences towards home-ownership aspirations in the UK and US. America is a vast country and it’s not uncommon for young professionals to relocate to a different state should an interesting job or career opportunity arise. Often this may be undertaken with the intention of the move being indefinite, but it can be equally appealing to some wishing to move for a much shorter period, of perhaps six months to a year. It’s just much more frequent for people to pick up and move. Therefore, the aspiration to own a home doesn’t have as great an influence on people’s lifestyles when compared to the UK, where we tend to settle more and possibly for longer periods to ‘put down roots’. Consequently, in the UK, our obsession with homeownership directly influences the way our BTR market is evolving.

This brings into question, with a possibly higher level of acceptance that people may be more ‘transient’ and uproot more frequently, why is the more convenient option of moving into a fully-furnished apartment not offered more widely? Perhaps this is an area in which the data emerging from the UK market may support a differentiation point within the US.

Bills and cost transparency

Along with the more ‘transformative’ elements of renting that Build-to-Rent has helped bring about in the UK’s PRS (Private Rented Sector) scene, BtR developments often advertise a ‘no fees’ and ‘no deposits’ approach to renting. To encourage a country which is culturally fixated on home ownership, the BtR market had to address some of the negative perceptions of renting along with the reputation of the PRS sector in general. Part of this approach was to adopt a very transparent leasing and pricing structure which meant moving away from having any ‘hidden fees’. Convenience and guest experience are cornerstones of the BtR movement, so monthly rental payments typically aim to be easy to understand and are as inclusive as possible.

That being said, one of the notable differences in the US context was just how many ‘extras’ there are for new residents to consider when perusing the monthly costs. The quoted rental value was strictly just that - it didn’t allow for any fees, leasing charges or credit checks. Once a resident has moved in, they pay separately for utilities, local city taxes and surcharges, trash (refuse) collection, phone line, TV & comms provider. However, as you would come to expect with the hospitality influence on the multi-family market, you only have to ask typically what these costs are, and the staff/management team will happily supply the answer. They are not only incredibly knowledgeable about their communities and all associated details but also passionate about their jobs and their customers’ happiness – this was evident in everyone we met during the study tour!

Pet-friendly

The additional cost (in the UK) for owning a pet, is typically £15 per month for a cat and £25 per month for a dog (with a weight limit and restriction on certain species). In the US, most multi-family schemes have the exact same approach for accommodating and charging for pets (allowing for a nominal £ to $ conversion rate) with one of the examples from the study tour considering its more relaxed approach to welcoming all types of pets and species to be a unique selling point.

The approach towards interior design when it comes to material and finish selection is understandably influenced by the rental model, with Multi-family/BtR developments having a sophisticated approach towards robustness and suitability of materials. Designing in the wrong type of finish could be incredibly costly from an operational expenditure point of view. This is exacerbated by the increasingly pet-friendly nature of the markets, where carpets and the spec of upholstery has to be carefully considered against the time and cost of cleaning/replacement once a resident (or more importantly their pet) opt to move out. This again supports the trend away from carpets in the bedrooms. Similarly, some of the floor finishes in high-traffic areas, such as the kitchen, are approached differently when considering the likelihood of tiny feet with claws scrambling around their owner’s feet during cooking.

Pet-friendly

The additional cost (in the UK) for owning a pet, is typically £15 per month for a cat and £25 per month for a dog (with a weight limit and restriction on certain species). In the US, most multi-family schemes have the exact same approach for accommodating and charging for pets (allowing for a nominal £ to $ conversion rate) with one of the examples from the study tour considering its more relaxed approach to welcoming all types of pets and species to be a unique selling point.

The approach towards interior design when it comes to material and finish selection is understandably influenced by the rental model, with Multi-family/BtR developments having a sophisticated approach towards robustness and suitability of materials. Designing in the wrong type of finish could be incredibly costly from an operational expenditure point of view. This is exacerbated by the increasingly pet-friendly nature of the markets, where carpets and the spec of upholstery has to be carefully considered against the time and cost of cleaning/replacement once a resident (or more importantly their pet) opt to move out. This again supports the trend away from carpets in the bedrooms. Similarly, some of the floor finishes in high-traffic areas, such as the kitchen, are approached differently when considering the likelihood of tiny feet with claws scrambling around their owner’s feet during cooking.

Affordability

Rents in California are incredibly expensive and to qualify for the majority of the credit checks, you’d need to be bringing home approximately three times the annual rental value. That being said, salaries are higher too. Most providers use the same metric for assessing affordability; calculating the monthly rent across a year and multiplying it by either two-and-a-half or three times to suggest a minimum income range. Similar to the UK and our affordable housing provision, there are lower-income and moderate-income programmes available, where apartments are available at a discounted rent.

Upon first walking around some of the smaller developments, the generous level of amenity and hospitality on offer surprised me considering the lower-than-expected number of apartments (such as Viciat 97 homes). I assumed this was achievable because the US market had a more sophisticated way of operating their developments, given they were ‘decades ahead’ than the UK, but perhaps it is also an indicator of just how much more rent these developments can demand when in such desirable locations within Southern California?

Refreshing the product

Perhaps one of the more tangible areas in which we can learn directly from the US is regarding product refurbishment and how developers, operators and even funders prepare and facilitate a refresh cycle following numerous years of stabilisation with continued high levels of occupancy. In the US, because the multifamily market is so well bedded in, the more established developers and operators are constantly refining their product in an evolving market set against a backdrop of increased competition.

In the UK, we're still trying to learn from the first and second waves of BTR, which took place from 2014-2016 and 2017-2019 respectively. There is a lot for us to learn from the multifamily market, such as, how do they refresh their products? How does the refurbishment cycle work? When do they replace carpets, kitchens, bathrooms? If we reference the hotel industry, they may plan to do a light refurbishment of the brand every five to ten years and then a major refurbishment around every 15 to 20 years. Some of the US schemes we visited were working on an eight-year cycle. Every eight years, they refresh their product with regards to finishes (typical walls, floors and some loose fittings) and then every 16 years, they consider more radical changes, which may include remodelling the bathrooms and kitchens.

In the UK we’re still learning how to build refurbs into the operational model in order to stay relevant against the competition. Some of the older schemes in this country probably need to be looking to refresh their interiors about now. In fact, some of the first wave of BtR schemes chose to introduce changes very early on within their product life, after a couple of years; such was the acceleration of the popularity of BtR and the pace and maturity of the market in response. Perhaps one of the earliest trends we observed in the UK BtR market was the remodeling of apartments into additional amenity space (commonly gyms, residential lobbies or private dining spaces). More recently, post Covid-19, we have seen remodeling apartments to respond to the work from home movement, sometimes through converting bedrooms into home offices, sometimes to make way for communal amenity areas to be used as small co-working spaces (you can read more about these trends in our other insight papers). Back in the US, marketing strategies will need to evolve to deal with products that may be perceived to be ‘dated’. And, as we’ll see with the US examples shortly, when compared to their ‘existing’ counterparts, the refurbished apartments are able to instantaneously command higher rents.

Marketing and leasing tactics

Our final difference as part of this paper relates to marketing. In the States, they are looking to reduce staff headcount and increase automation wherever possible. But, they always retain an apartment as a show apartment, whereas in the UK, we see that as valuable rentable floorspace. So in the UK, if a scheme is 100% occupied, you can't show anyone an apartment, you'd have to agree with an existing tenant to show them one of theirs. Whereas in the US, they place greater emphasis on the leasing and selling of the apartments. So, they'll always retain the show apartment.

Examples of some California schemes:

The schemes that I saw were all pet friendly, some had pet spas and dog parks, and most had a gym or a health club. They all had like a clubhouse or a residents’ lounge or a social lounge and a pool/hot tub. Some advertised electric car charging. There were a few places with co-working facilities. Barbecues, fire pits and rooftop spaces were very common.

Typically, there are larger circulation spaces and bigger size apartments than in the UK. Signage is very prominent and often standardised, eg. men’s and women’s toilet signs, rules and regulations, there’s very little consideration of its impact on interior design.

Conclusion

My recent tour of California multifamily schemes presented more similarities to the UK Build-to-Rent market than I was expecting. In the images that follow you can see the number of amenities and focus on pet-friendly facilities, for example.

Perhaps what was most striking is that not all differences which remain are a result of the US being ‘more mature’ and in fact, we believe there are things the US multi-family market could learn from the way the UK Build-to-Rent market has evolved (needs rewriting, just from intro). At Chapman Taylor, our expertise in the sector is unmatched, from schemes like Kampus in Manchester to Castle Park View in Bristol. Our designs are centred on the needs of residents, with a sharp focus on market trends and an eye on the future.